ShopKoreaOnline: The Best Source for K-Pop, K-Beauty, K-Food & K-Fashion

Affiliate Disclosure: When you click on links to various merchants on this site and make a purchase, this can result in this site earning a commission. Affiliate programs and affiliations include, but are not limited to, the eBay Partner Network.

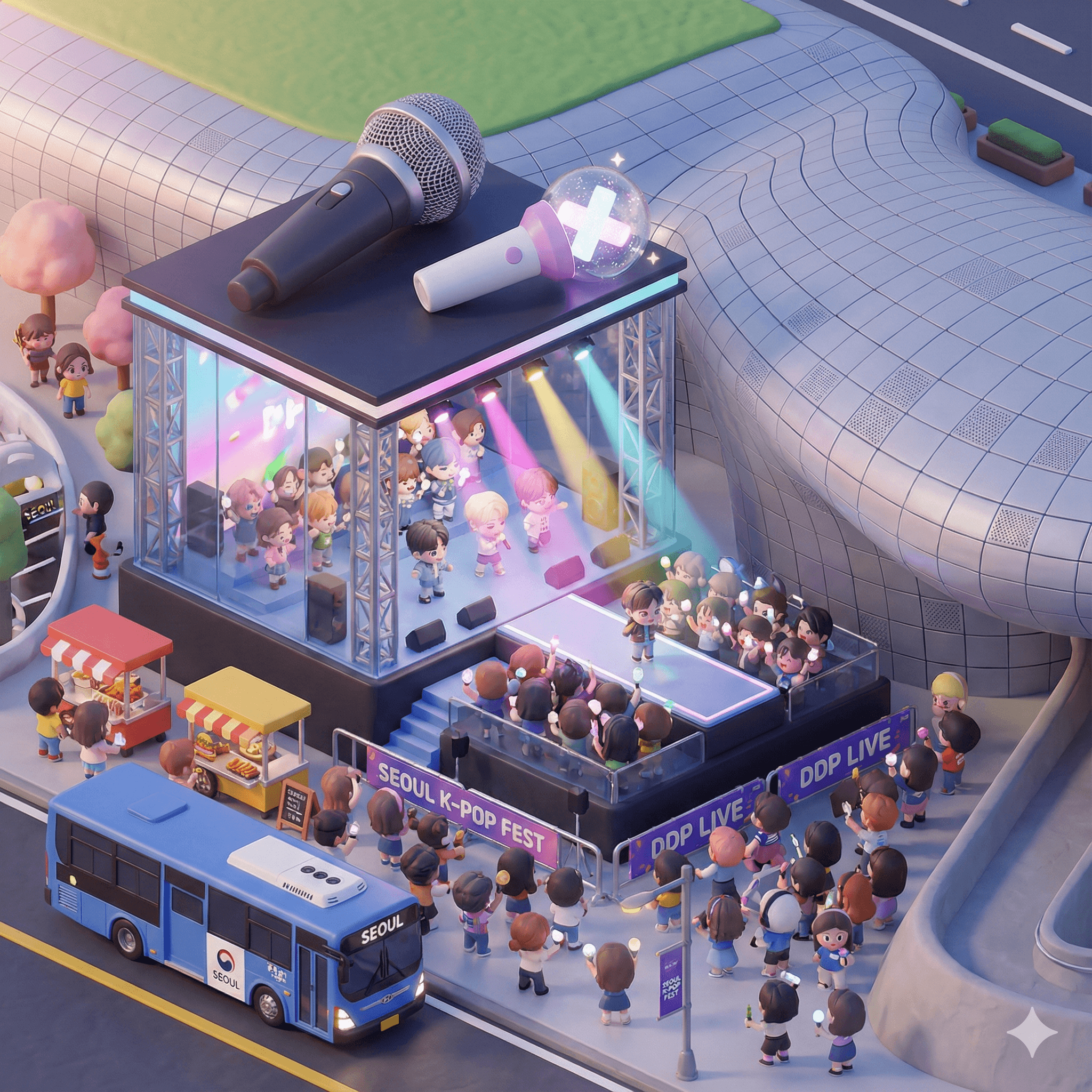

K-Pop

All Your Stars

K-POP UNIVERSE

K-POP UNIVERSE

Collect your favorite idols' albums and limited edition merchandise.

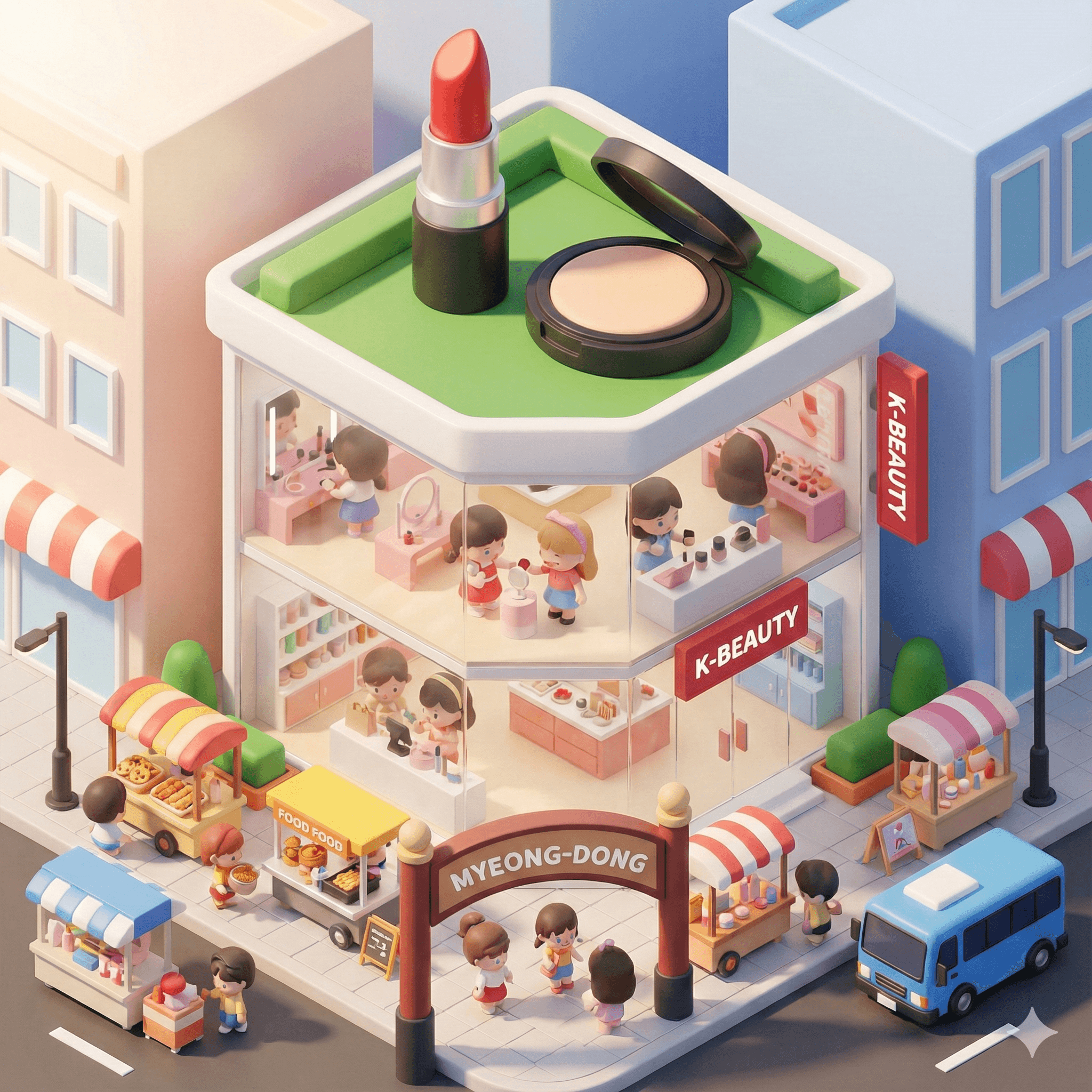

Beauty

Glow Up With

K-BEAUTY SECRETS

K-BEAUTY SECRETS

Discover glowing skin with trending Korean skincare and makeup.

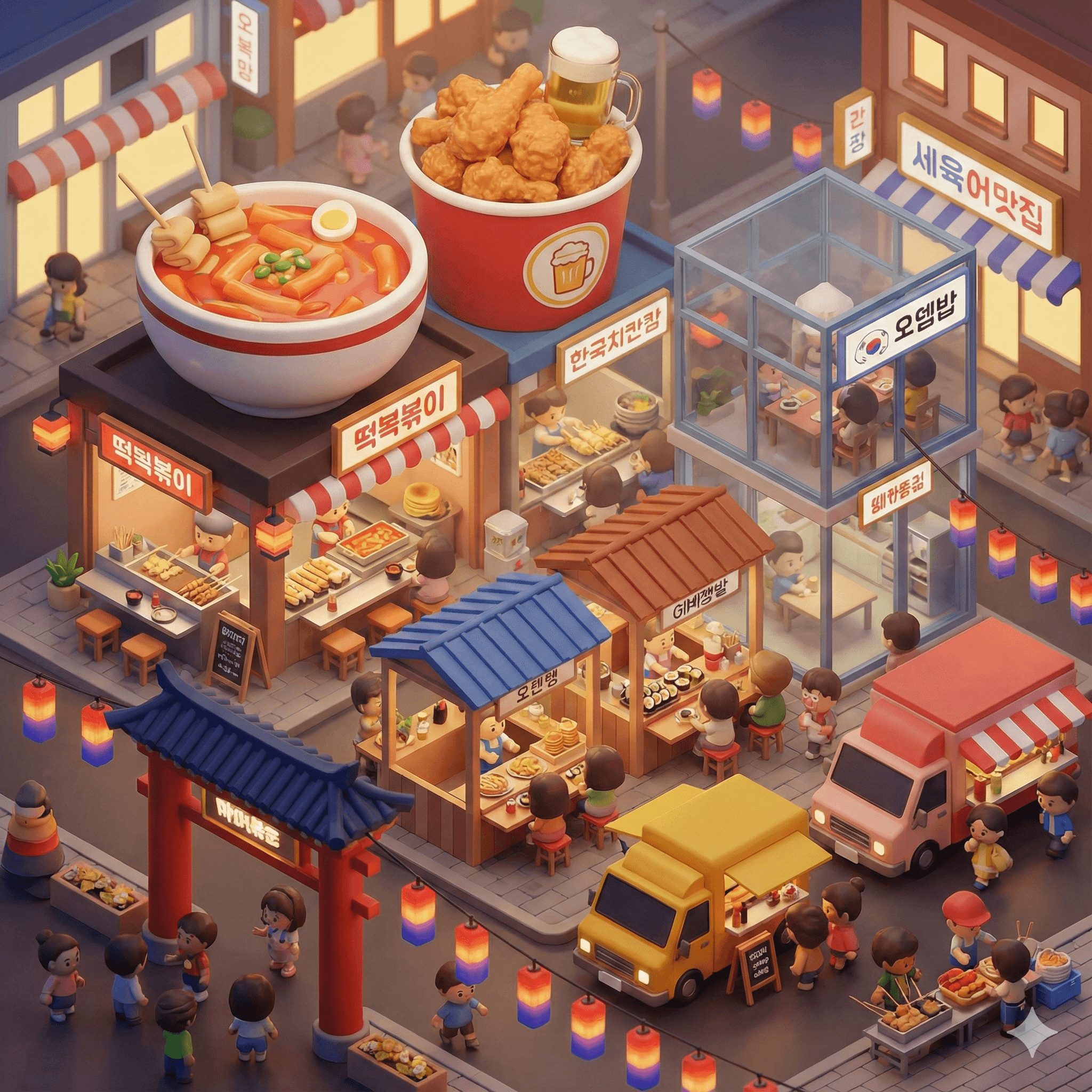

K-Food

Taste of Korea

K-FOOD PARADISE

K-FOOD PARADISE

Experience authentic Korean flavors with trending snacks and ramen.

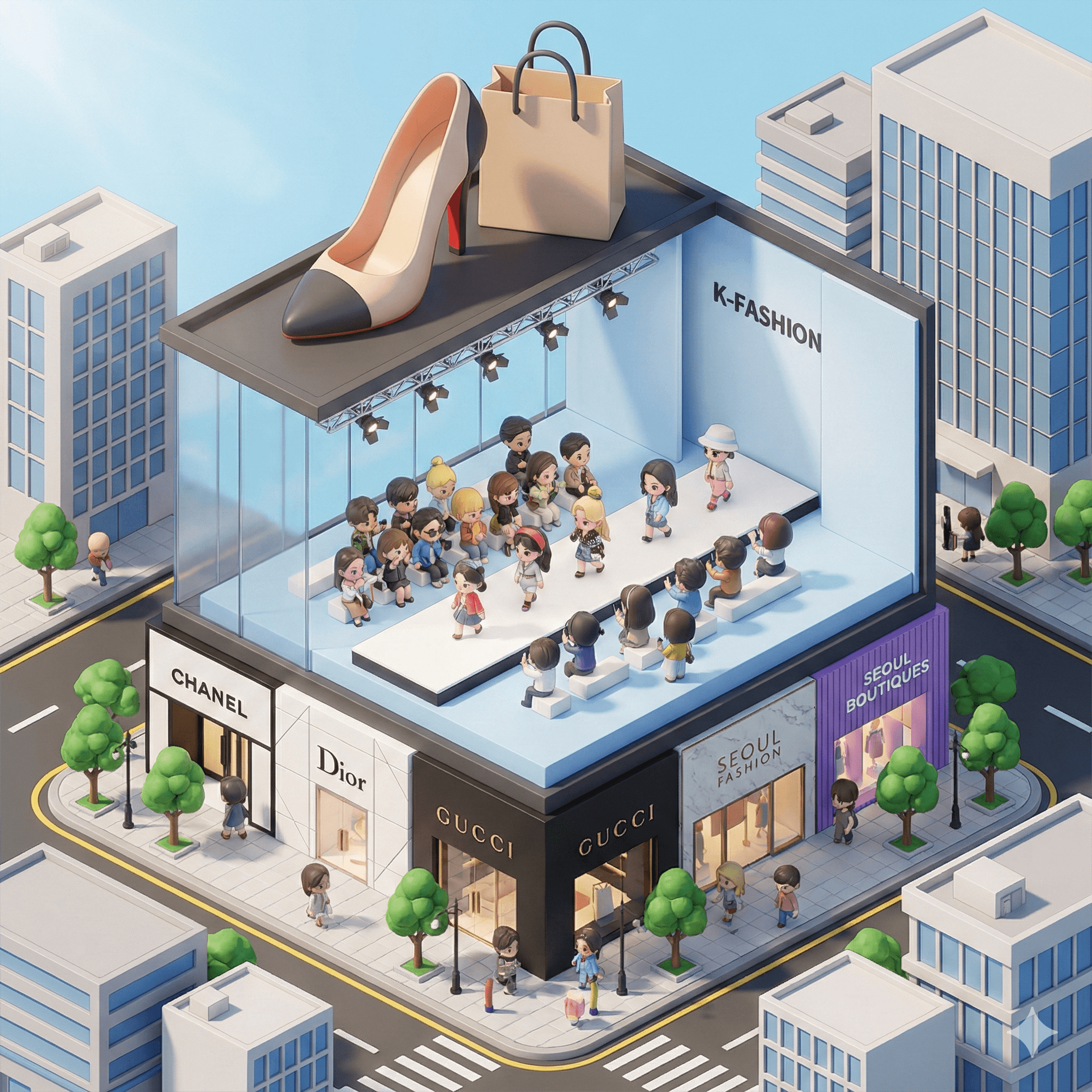

Fashion

Style Your Look

K-FASHION TRENDS

K-FASHION TRENDS

Dress like a star with the latest Seoul street styles and accessories.

For You

DISCOVER YOUR WORLD

Curated K-Pop, Beauty, Food & Fashion